Electricity transition to a renewable energy system has never been more attractive, and as far as solar power is concerned, U.S. homeowners have taken the lead. As federal solar incentives have made the cost of installation cheaper than ever, thousands of families are cutting down energy costs and adding home value.

Federal Solar Investment Tax Credit (ITC) – one of the strongest incentives that assists homeowners with adopting solar is the program that directly decreases their initial expenditure and the solar payback period. This credit is one of the best reasons to switch now instead of setting it by the year 2025.

What Is the Federal Solar Tax Credit?

Investment Tax Credit (ITC) Federal Solar Tax Credit, otherwise known as Investment Tax Credit, is a tax credit that permits homeowners and businesses to set off the amount of money they paid on the purchase of their solar systems on their federal tax bills. It was established back in 2006 and has contributed massively towards the adoption of solar energy in the U.S.

The ITC gives a 30 percent tax incentive on solar panels in residential houses and businesses in 2025. This means:

- An investment in a solar installation that costs you $20,000 can allow you to subtract $6,000 of your federal taxes.

- This deduction can be taken on equipment, labor, or permitting fees, and even solar batteries you put up with your panels.

The ITC makes clean energy more affordable, but also enables homeowners to get a quicker payback on their investment by reducing the cost of purchasing an upfront solar system.

What Is a Solar Payback Period?

Your solar payback period is the time to recover your savings in electricity bills over the total Solar system purchase. Once past that, the solar energy will be effectively free energy until the end of the lifetime of your system, which is well past 25 years on new panels.

Major reasons that affect the time required to pay you back include:

- System cost: your pre- and post-incentive cost to install.

- Annual energy usage: The savings in your utility bills per annum.

- Incentives & rebates: Such programs are the federal, state, and local programs that lower the costs.

- Use of Energy: The higher the electricity you use, the more you save.

- Advantages of net metering: You rate of credit after selling excess energy to the grid.

How the ITC Shortens Your Payback Period

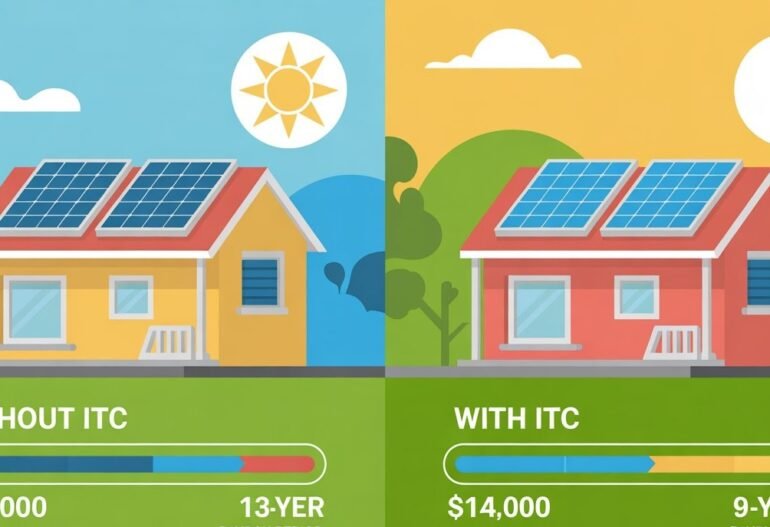

This Federal Investment Tax Credit (ITC) means your solar return on investment is turbo-charged. Case in point, a solar system at a cost of \$20,000, which saves \$1,500 each year, would not recoup itself in approximately 13.3 years in the absence of the ITC. Nevertheless, the net cost goes down to \$14,000 with the 30 percent ITC, with no change in annual savings, so the payback period decreases to 9.3 years. Four years faster to start paying back their investment, four more years of emissions-free power, until most homeowners can at all consider replacing their shingle roofs.

Other 2025 Factors That Affect Your Payback Period

- Decreasing Prices of Solar Energy

As the National Renewable Energy Laboratory (NREL) points out, the cost of solar systems serving households has fallen by more than 60 percent over the last 10-year period, and technological advancements are expected to continue bringing prices down in 2025.

- Increasing Utility Price

According to the U.S. Energy Information Administration (EIA), in 2024, the average price of electricity for residential use increased by 4 percent, and the price is expected to continue growing. That is to say that every year you are not getting utility increases, your savings towards solar are growing.

- State & Local Incentives

In 2025, many states will continue to provide additional rebates, additional property tax exemptions, or performance incentives. For example:

California: Battery storage Self Generation Incentive Program (SGIP)

- New York: NY-Sun rebate program

- Texas: Hundreds to thousands of dollars in local utility rebates

- Policies of Net Metering

When you participate in full retail net metering, each incremental kWh you feed into the power grid will make you a credit on your bill. This may shorten your payback period by months or even years.

A question that has already been asked is Will Solar Be Worth It In 2025?

Yes–and this is why:

- Beyond 2032, 30 percent ITC remains on the table at least

- A record-low panel cost

- Electricity costs are rising with each passing year

- The growth of battery storage incentives in the United States

Even better, newer solar panels are more efficient, longer-lasting, and durable, meaning your system continues to generate your free electricity well into its payback decade.

FAQ in a nutshell: Federal Solar Tax Credit 2025

Q: May I use ITC on solar batteries?

Yes, since 2023, the ITC includes standalone energy storage systems.

Q: Does the Federal Solar Tax Credit have a cap?

Not, no, like there is no limit to the ITC.

Q: What do I do when I do not have sufficient levied taxes to be able to claim the credit in full?

The unused credit can be rolled over to the following tax year.

Q: Is ITC on rental premises?

Yes — you may qualify as long as you own the building, and there is solar on it.

Final Takeaway

One of the strongest incentives to homeowners in the year 2025 is the Federal Solar Tax Credit. It lowers your bottom line, including your up-front expenses and significantly shortens your payback period, making solar a paying-back investment that continues to pay you in the decades that follow.

Get 30 percent ITC before it expires if you are prepared to reduce your bills, cushion yourself against future electricity rate increases, and install renewable energy products into your home.